Vroom Vroom: “Newer” Doesn’t Mean “Better”

In 2021, Hertz announced their entry into the electric vehicle (EV) space with the purchase of 100,000 Teslas. They even hired Tom Brady to headline the ad campaign. Now, they’re selling 20,000 EVs and purchasing gasoline cars instead.

The reasoning? High damage-repair costs and depreciation for EVs have been impacting their bottom line. Did you know that the price of repairs for an electric vehicle can be twice as much as that of a combustion engine vehicle?

Similarly, within real estate, “newer” isn’t always “better”, or cheaper for that matter.

Construction

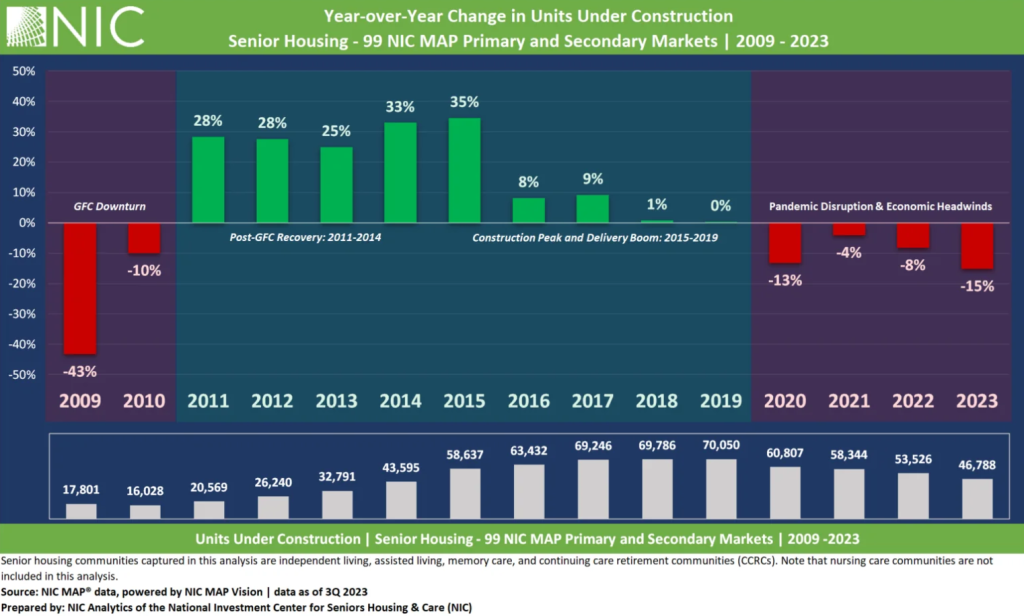

Challenges such as increased construction costs, labor pressures, licensing hurdles, and tension within the capital markets have strained the incoming supply of new senior housing construction for years. As a result, units under construction for the senior housing industry have experienced a negative trend year-over-year since 2019.

Cost

Put simply, new senior housing communities cost more. Construction and material costs increases have been a theme since 2018, with supply shortages and shipping delays adding instability to the challenges. Further, todays “latest and greatest” amenities are far from what they were. On-site movie theatres, spas, and carefully crafted rotating menus (to name a few) have to be seriously considered for a new senior housing product to remain competitive in 2024. These “lifestyle” amenities coupled with advancements in technology/telehealth to improve caregiver efficacy harbor significant costs.

Time

Not only does the construction of a new senior housing community require a significant amount of capital, it also requires a considerable amount of time. In 2023, the industry average for the construction of a new senior housing community was 25 months. This has grown from an average of 16 months in 2019, and 19 months in 2019. Challenges stemming from the pandemic, high interest rates, and other economic factors have only contributed to the observed prolonged construction durations.

Even when construction has been completed, these communities will need to be licensed, staffed, and ~90%+ occupied with residents before any operational income can be produced – if operated effectively.

The Solution to Construction Woes? Skip Them.

Though the senior housing sector is performing better than it was pre-pandemic, gaining back twice the doors relinquished within 10-months, not all communities have enjoyed this positive performance. The economic and operational strains the pandemic enacted highlighted numerous underperforming communities throughout the nation. Many of these communities are well-designed and in attractive locations yet lacked the infrastructure to remain competitive amidst the intricacies of changing regulations and economic strains.

We intend to acquire these “Value-Add” communities at affordable cost, subsequently utilizing our industry expertise to improve overall community sales values before seeking exit and providing returns to our community of investors.

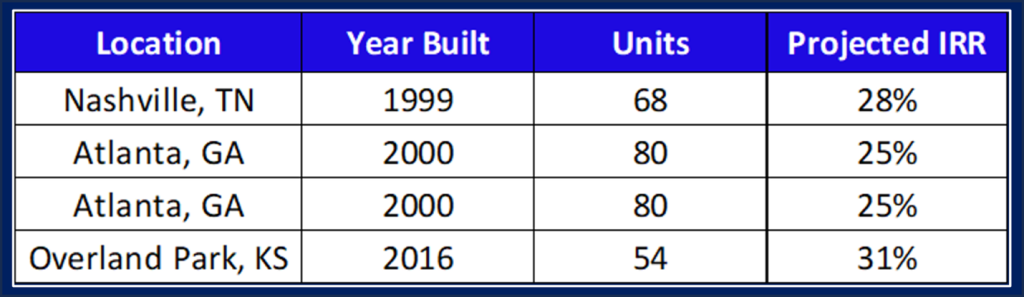

In 2023, we finalized the acquisition of a senior housing portfolio in the Southeast valued at $20 million. The portfolio consisted of two communities in Georgia, as well as one community in Tennessee. We purchased these communities as value-add investments, with intent to improve operational performance at all three of the locations before seeking exit and returning associated profits to the Value-Add funds. We now have invested in four value-add communities, with more such investments anticipated.

We are currently projecting the IRR for each of our value-add communities significantly higher than how the Value-Add fund NOIs were modeled. We have attached our current projections for these communities below:

Didn’t get a chance to read about the acquisition? The attached article features comments from our Chief Fund Manager, Dan Brewer, as well as our Field Operations Manager, Brian Colgan.

Want to learn more? Contact us at Team@seniorlivingfund.com, or call (913) 283-7804.